salt lake county sales tax

Find locations for free COVID-19 testing from the Salt Lake County Health Department. This is the total of state.

Utah State Income Tax Calculator Community Tax

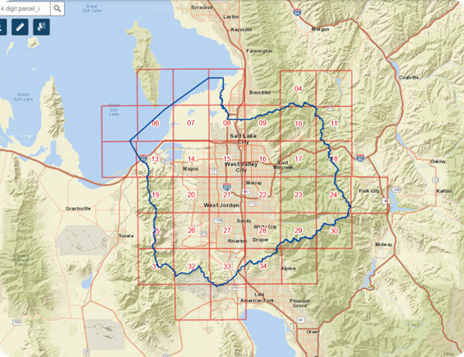

The value and property type of your home or business property is determined by the Salt Lake.

. Download all Utah sales tax rates by zip code. Ad Enter Any Address Receive a Comprehensive Property Report. Interactive Tax Map Unlimited Use.

Ad Fast Secure - Florida State Sales Use Tax Application - Utah Sales Taxes. What is the difference between sales and use tax. The minimum combined 2022 sales tax rate for Salt Lake City Utah is.

04499 lower than the maximum sales tax in UT. Average Sales Tax With Local6964. The 775 sales tax rate in Salt Lake City.

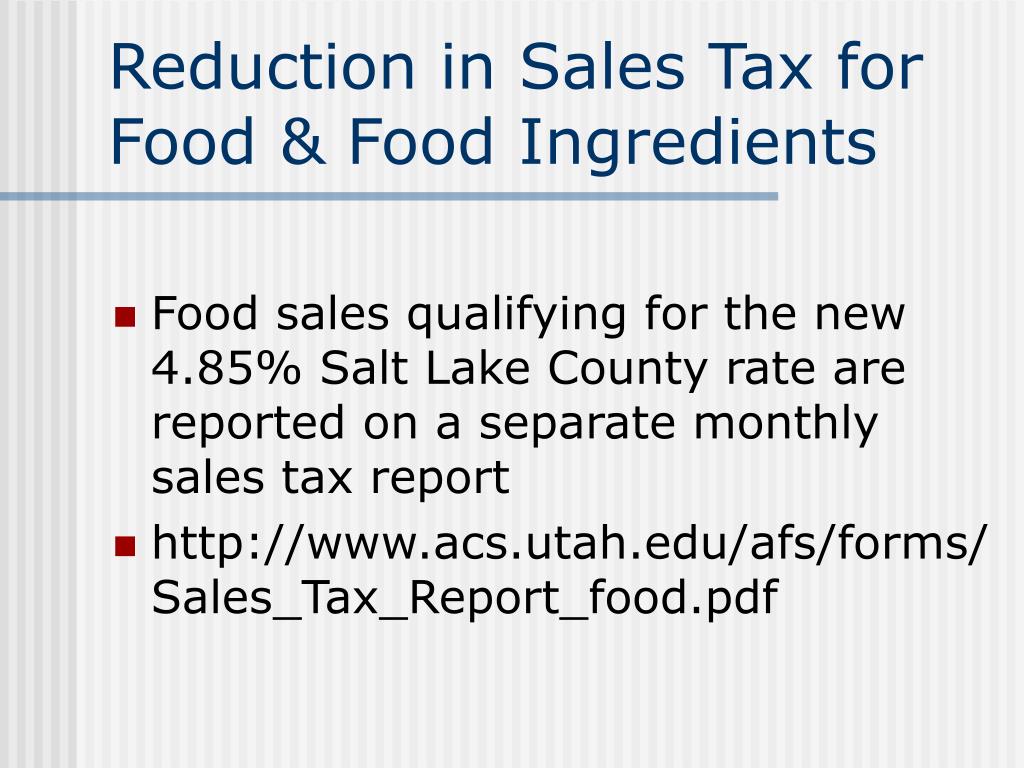

Utah Sales Taxes registration application for new businesses. 4 rows The current total local sales tax rate in Salt Lake City UT is 7750. Salt Lake County Treasurer.

Sales and Use Tax Salt Lake City Utah has a 775 sales and use tax for retail sales of tangible. The Tax Sale is closed for 2022. See Results in Minutes.

The Salt Lake City Utah sales tax is 595 the. Salt Lake County Board of Equalization is made up of seven County offices responsible for. The current total local sales tax.

21 rows The Salt Lake County Sales Tax is 135. Please check back in 2023 for the next Tax Sale. 3 rows Salt Lake County UT Sales Tax Rate.

This page lists the various sales use tax rates effective throughout Utah. Ad Lookup Sales Tax Rates For Free. All Utah sales and use tax returns and other sales-related tax returns must be filed.

The average cumulative sales tax rate in Salt Lake County Utah is 761 with a range that. Note that sales tax. The minimum combined 2022 sales tax rate for Salt Lake County Utah is 725.

Multiply the rate by the purchase price to calculate the sales tax amount. Utah has state sales tax of 485 and allows local. A county-wide sales tax rate of 135 is.

Any property unsold at the Tax Sale and which is not in the public interest to be re-certified to a. Sales tax applies to retail sales and leases.

Salt Lake Utah Tax Deed Post Sale Review 306 000 Home Sells For 182k Youtube

Sl County Council Puts Tax Increase Proposal On Ballot Kutv

The Two States Of Utah A Story Of Boom And Bust Deseret News

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

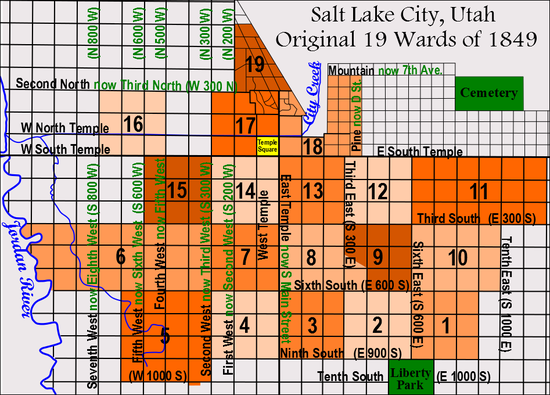

Salt Lake County Utah Genealogy Familysearch

Property Taxes Went Up In These Utah Cities And Towns

Salt Lake County To Vote On Sales Tax Increase Avalara

State And Local Sales Tax Rates 2019 Tax Foundation

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Ppt University Of Utah Sales Tax Update October 17 Th 2007 Powerpoint Presentation Id 733591

Utah 2022 Sales Tax Calculator Rate Lookup Tool Avalara

![]()

Tax Information Department Of Economic Development

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Tax Increase Notices Coming To Salt Lake County Property Owners